living benefits life insurance

living benefits life insurance philadelphia pa

Life insurance policies may offer living benefits without extra charges. Term life policies usually include a terminal illness rider for no additional charge. Ask your agent whether there are charges for critical illness, chronic illness, or other riders.

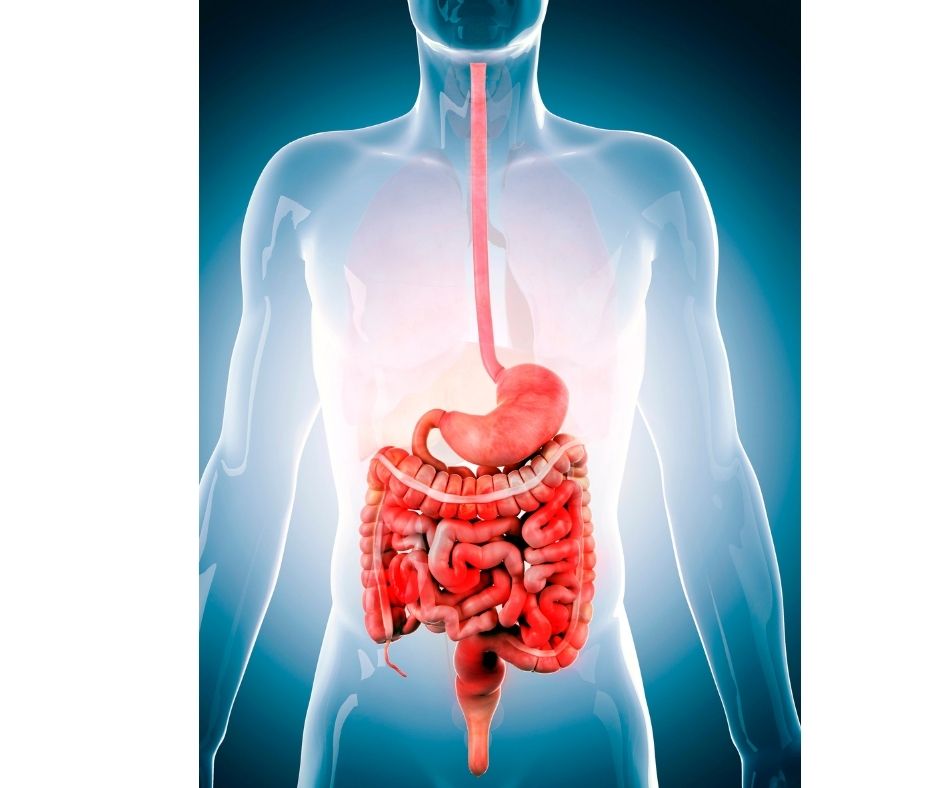

It is available to you if your chronic illness makes it impossible for you to perform at most two of the six Activities of Daily Living.

Standard is the option to add a life benefits rider to your initial purchase of life insurance. Many policies come standard with at least one living benefit rider. This could be a terminal condition.